Press Release: State-owned public finance institutions utilize green finance frameworks to invest in maritime LNG projects, new report finds

February 2, 2026 | State-owned public finance institutions have directed nearly USD 22 billion into 62 maritime LNG projects between 2013 and 2025, leveraging green financing frameworks to allocate 36 percent—or USD 8 billion—of these investments, according to Mapping Public Finance in the Shipping Sector, a new report released today by Maritime Beyond Methane (MARBEM).

The report also finds that USD 12 billion—more than half of the USD 22 billion invested into maritime LNG projects over the period—was allocated specifically to LNG-fueled vessels and bunkering infrastructure, which together comprised one-third of the total number of projects. LNG carrier vessels were supported by half the projects, and green financing frameworks were used for 11 projects, with 10 supporting LNG-fueled vessels, bunkering and LNG carrier vessels.

All 62 maritime LNG projects were supported by loans, credit guarantees, and other forms of capital (including equity and sale and leaseback arrangements), marking substantial financial exposure to 19 state-owned public finance institutions and their private subsidiaries.

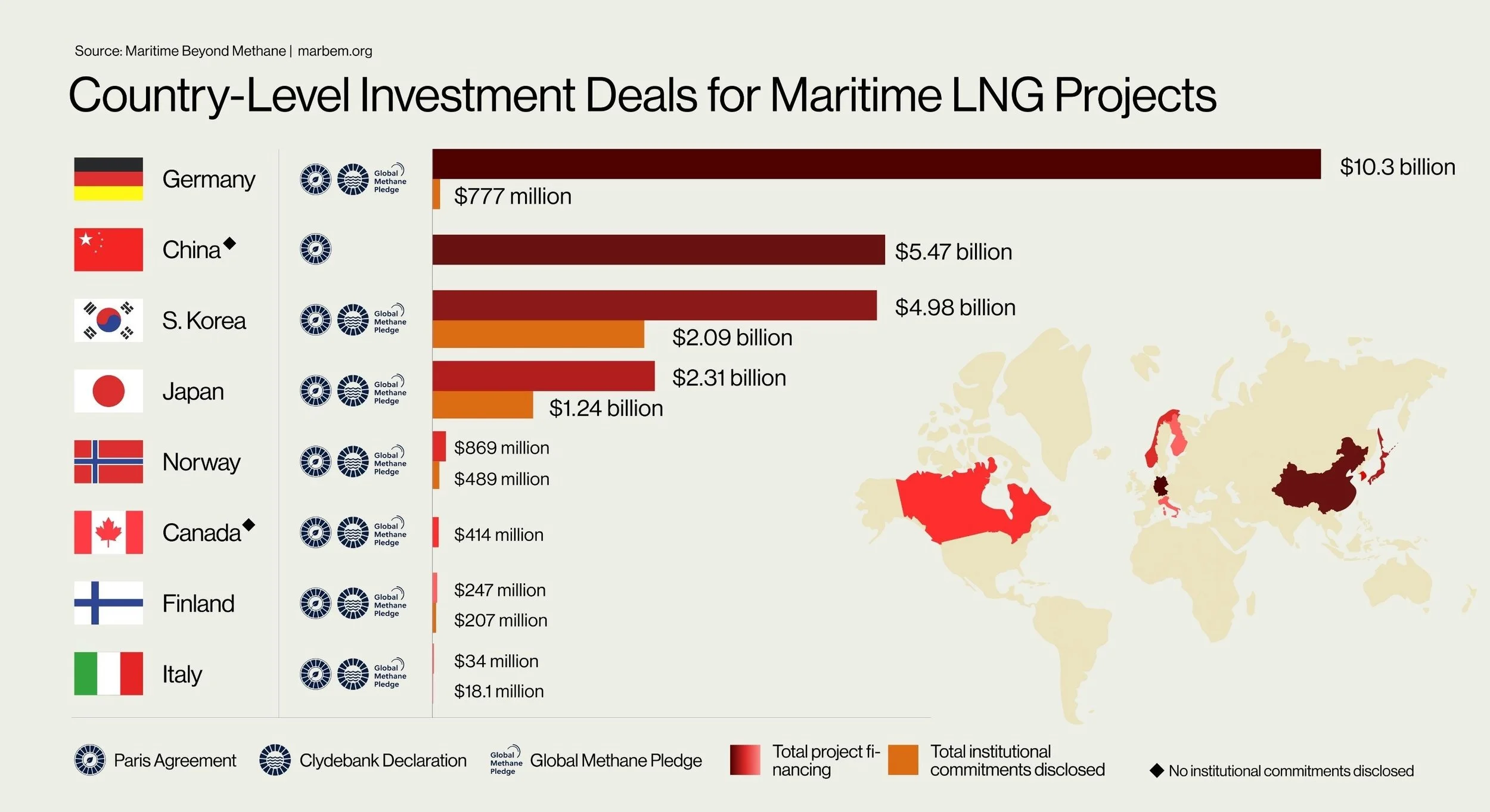

The report distinguishes between export credit agencies, multi- and bilateral development banks, and their private subsidiaries, to show each institution’s individual contributions, as well as country-level investments into maritime LNG projects. Over the study period, Germany and Japan participated in the highest number of institutional investments, with 20 and 19, respectively.

A trend that emerged in the data shows that frameworks for green finance only started to be utilized by multilateral development banks in 2015 for investments into maritime LNG projects. Such investments were undertaken by the European Investment Bank, the Asian Development Bank, and the New Development Bank.

At the country level, green financing mechanisms for maritime LNG investments were utilized during the study period by the Korea Trade Insurance Corporation (KSURE) and the Export-Import Bank of Korea (KEXIM); the China Export & Credit Insurance Corporation (SINOSURE) and the Export-Import Bank of China (CEXIM); the Norwegian Export Credit Guarantee Agency (GIEK) and Export Finance Norway (Eksfin); and Germany's KfW IPEX-Bank.

LNG is almost entirely methane, a greenhouse gas over 80 times more potent than carbon dioxide at warming the planet in the near-term. Methane slips from marine engines and leaks throughout the LNG supply and infrastructure chain create measurable climate, health and safety risks. These material risks render LNG incompatible with net-zero regulatory goals and long-term decarbonization pathways for the marine shipping sector.

The report’s recommendations are directed to states and their public finance institutions, as well as multilateral development banks. The report calls for public capital to encourage private capital investments in ways that eliminate sustainability funding loopholes to ensure investments accomplish genuine decarbonization in the shipping sector.

“LNG is methane, a climate super pollutant over 80 times more potent than CO2, and yet somehow governments are using green financing frameworks to back the expansion of LNG maritime infrastructure rather than stimulating direct public and private capital into zero-emission technologies. State-owned institutional lenders have no business de-risking private-sector investments into maritime LNG when industry isn’t willing to carry these high-risk investments.”

“Governments cannot continue to include fossil gas, like LNG, in their taxonomy for sustainable investment. It is baffling for LNG to be given these criteria, especially when regulators’ misguided reason for inclusion is because it has a ‘temporary role’ in the energy transition, like in the EU Taxonomy, Korea’s eco-friendly ship definition, and Japan’s next generation ship. Leadership, focus, and financing pathways must advance truly net-zero technologies that align with where the sector knows it has to go. To do otherwise is to dangle rewards for operators, setting them up for a harder and much more costly transition when LNG falls from the taxonomy—and that will be in the near future.”

Recommendations include:

Establish clear guidelines for sustainable, green finance that explicitly exclude funding for maritime LNG projects.

Improve visibility into financial intermediary structures.

Enhance transparency in financial reporting.

Establish an open, centralized database for maritime public finance.

-

Link to report: https://www.marbem.org/resources/lngpublicfinance

-

Allison Murray

(+1) 604-442-1846 | media@marbem.org